Introducing: a brand-new design for our Personal Finance Portal, plus why using this resource could benefit you

The eagle-eyed among you may have noticed our client portal, which we call our Personal Finance Portal (PFP), received a new lick of paint over the Christmas period.

The new, modern visuals better incorporate Chancellor’s branding, while providing you with a much easier system to navigate. In addition, the dashboard has been improved with new software, enabling us to tailor the portal experience to your needs.

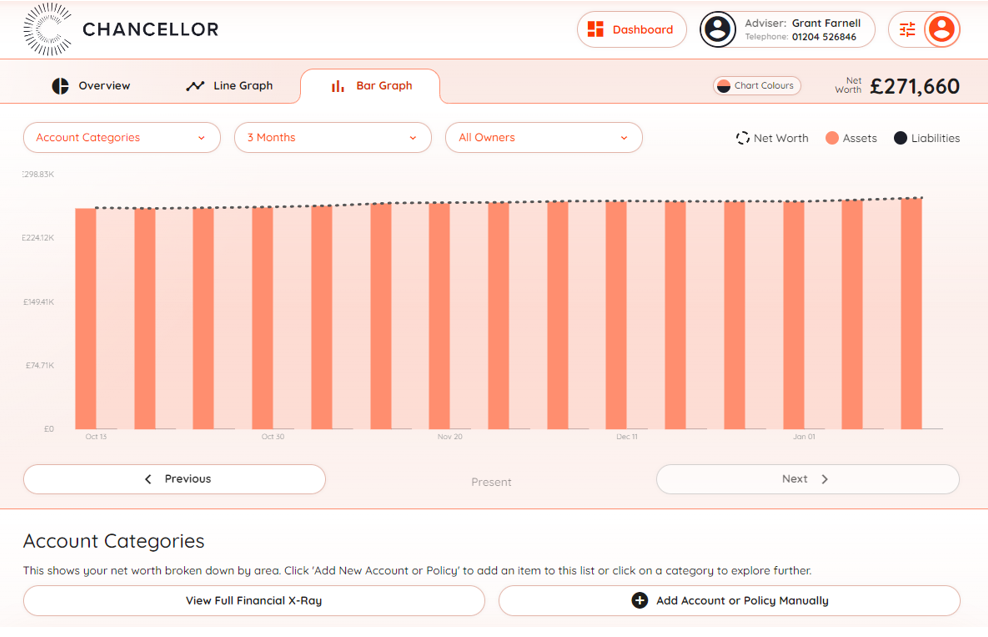

Below is an example of how the PFP looks since its renovation.

Our portal has a new look, with the same amazing benefits for all our clients

You might be wondering: “how will the portal’s new design affect me?”

If you already have a login for the PFP, nothing has changed. Everything will continue working as it always has, only with a newer, glossier design!

Alternatively, if you haven’t been using it very much – or at all – you’ll now see some big changes when navigating through the menus.

If you don’t have a login yet and would like to sign up to our PFP, you can register yourself on our website.

Plus, there are further enhancements to the PFP planned for 2023, and we will let you know as these arrive.

We plan to implement digital signatures as part of the modernisation process

One big shift we want to implement in 2023 will be to switch to digital signatures.

We aim to introduce a digital signature system, that is both secure and easy to use, for all our internal and external documents.

This enhanced feature should improve service levels and turnaround times, while having a positive impact on the environment by reducing the amount of paper and ink we have to use.

The amazing benefits of using our Personal Finance Portal (PFP)

The PFP enables you to view all your finances in one place on any mobile or web device.

What’s more, the PFP enables you to view your fund information and financial portfolio in an instant.

So, whether you’re looking for an up-to-date valuation of your portfolio, or want to assess how you’re progressing towards your goals, the PFP has it covered.

In addition, our portal boasts the following features:

- You can get in touch with us securely. If you ever need to include information that is data-sensitive, you can message us safely through the PFP, rather than sending an email.

- Similarly, you can send and receive important documents securely.

- You’re able to easily view the details we hold about you (that we base our advice on), and change them if necessary. You can also set alerts, so your adviser is instantly made aware of these changes.

- Lastly, should you choose to do so, you can link your bank account information to the PFP. This means you will benefit from having all your financial information in one place. The system will categorise your spending and analyse it, which can help with all aspects of planning for your future.

Remember: you can register yourself on our website if you haven’t yet used the PFP.

Get in touch

If you have any questions about the PFP, or any other financial matter, email info@chancellorfinancial.co.uk, or call 01204 526 846 to speak to an adviser.